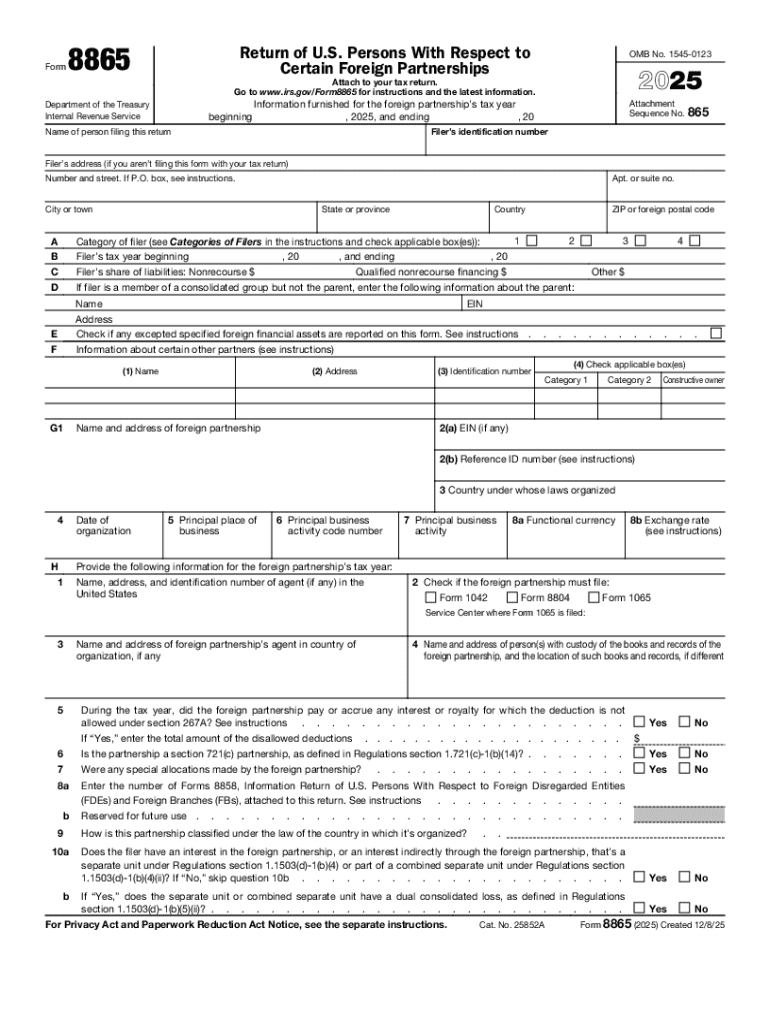

IRS 8865 2025-2026 free printable template

Instructions and Help about IRS 8865

How to edit IRS 8865

How to fill out IRS 8865

Latest updates to IRS 8865

All You Need to Know About IRS 8865

What is IRS 8865?

Who needs the form?

Components of the form

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

FAQ about IRS 8865

What should I do if I realize I made a mistake on my submitted IRS 8865?

If you discover an error on your IRS 8865 after submitting it, you need to file an amended return using the same form. Make sure to check the instructions for the IRS 8865 for guidance on how to indicate that it is an amendment. It’s essential to correct mistakes promptly to avoid penalties.

How can I check the status of my IRS 8865 form after submission?

To verify the status of your IRS 8865, you can contact the IRS directly or check your account if you filed electronically. The IRS typically provides updates on processing times and any issues that may have arisen. Keeping a copy of your submission will help when inquiring about your form.

Are there any special provisions for nonresidents filing IRS 8865?

Yes, nonresidents have specific rules to follow when filing IRS 8865. They may need to include additional forms or documentation to substantiate their foreign status and report their U.S. income correctly. Consulting a tax professional familiar with international tax law is advisable to ensure compliance.

What errors commonly occur with IRS 8865 submissions, and how can I prevent them?

Some common errors with IRS 8865 include incorrect identification numbers, failing to sign the form, or providing inconsistent information. To avoid these mistakes, carefully review all entries for accuracy and completeness before submission, and make use of e-filing software that can flag potential issues.

If my IRS 8865 gets rejected, what steps should I take?

In case your IRS 8865 is rejected, you should carefully review the rejection notice to understand the reason. Follow the instructions to correct the identified issues and resubmit the form as soon as possible. Keeping an eye on the timeline for filing will help ensure you don't miss any deadlines.