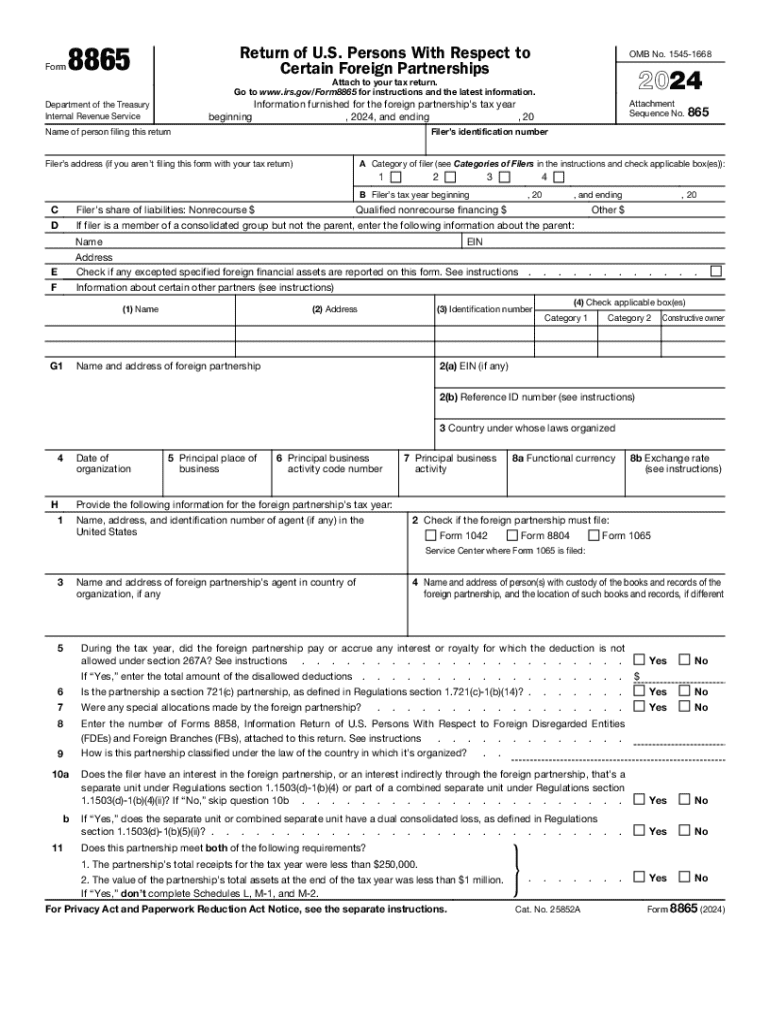

Does the foreign partnership need to file 8865?

A US person who is a partner in a foreign partnership (or an entity electing to be taxed as a partnership) is required to file Form 8865 to report the income and financial position of the partnership and to report certain transactions between the partner and the partnership.

Do I need to report foreign tax paid?

U.S. citizens have to report foreign income U.S. citizens and resident aliens are required to report their worldwide income on their U.S. tax returns every year. That means you must report all the money you made inside the United States, as well as any foreign income you received during the tax year.

Can Form 8865 be filed electronically?

Form 8865 returns can be electronically filed only if filing Form 1040, 1041, 1120, 1120S, or 1065. Multiple Form 8865 electronic files can be attached to the filer's return, as needed.

How do I report foreign partnership income on 1040?

In general, a U.S. person who is a partner in a foreign partnership is required to file Form 8865 to report the income and financial position of the partnership and to report certain transactions between the partner and the partnership. The form is required to be filed with the partner's tax return.

What is a 8865 tax form?

Form 8865 is filed for the foreign partnership by another Category 1 filer under the multiple Category 1 filers exception. To qualify for the constructive ownership filing exception, the indirect partner must file with its income tax return a statement entitled “Controlled Foreign Partnership Reporting.”

How does IRS know about foreign income?

One of the main catalysts for the IRS to learn about foreign income which was not reported is through FATCA, which is the Foreign Account Tax Compliance Act. In ance with FATCA, more than 300,000 FFIs (Foreign Financial Institutions) in over 110 countries actively report account holder information to the IRS.

What happens if you don't report international income?

The failure to report may results in penalties as high as 50% maximum value of the foreign account. The penalties can occur over several years. Still, the IRS voluntary disclosure program, streamlined programs, and other amnesty options can serve to minimize or avoid these penalties.

Do I have to report foreign income on US tax return?

Do I still need to file a U.S. tax return? Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live. However, you may qualify for certain foreign earned income exclusions and/or foreign income tax credits.

Do I have to file 8865?

The Form 8865 will need to be filed if a U.S. person owns an interest in a foreign entity that is classified as a foreign partnership for U.S. federal tax purposes.

Who should file 8865?

A U.S. transferor that is required to provide information with respect to a partnership under Regulations sections 1.721(c)-6(b)(2)(iv) and 1.721(c)-6(b)(3)(xi) must file a separate Form 8865 (along with all necessary schedules and attachments) for each partnership treated as a U.S. transferor under Regulations

How much foreign income is tax free in USA?

The maximum foreign earned income exclusion amount is adjusted annually for inflation. For tax year2021, the maximum foreign earned income exclusion is the lesser of the foreign income earned or $108,700 per qualifying person. For tax year2022, the maximum exclusion is $112,000 per person.

Do I have to report foreign income to IRS?

Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live. However, you may qualify for certain foreign earned income exclusions and/or foreign income tax credits. Visit Publication 54, Tax Guide for U.S.

Does a foreign partner need to file a US tax return?

A foreign partner must file an income tax return (Form 1040NR, Form 1120F, etc.) with a valid TIN. Note that Individual Taxpayer Identification numbers (ITINs) that haven't been included on a U.S. federal tax return at least once in the last three consecutive tax years will expire.

How do you report foreign partnership income?

In general, a U.S. person who is a partner in a foreign partnership is required to file Form 8865 to report the income and financial position of the partnership and to report certain transactions between the partner and the partnership. The form is required to be filed with the partner's tax return.

How do I report income from a foreign partnership?

If a foreign partnership has income from the U.S., they may be required to file Form 1065 to report that U.S. income. If a foreign partnership is considered a controlled foreign partnership, certain US partners may have to file Form 8865 to report their interest in that partnership.

Do I need to report foreign income on 1040?

The Bottom Line. As a U.S. citizen or resident alien, you must report foreign income to the IRS, regardless of whether you reside in the U.S. or not.

How are foreign partnerships taxed in the US?

A foreign partnership generally must file a U.S. partnership return if it has U.S. source income or income that is effectively connected with a U.S. trade or business. Payments to a foreign partnership of non-effectively connected U.S. source income are subject to a 30-percent withholding tax.

Can form 8865 be filed?

Form 8865 returns can be electronically filed only if filing Form 1040, 1041, 1120, 1120S, or 1065. Multiple Form 8865 electronic files can be attached to the filer's return, as needed.

How do I report tax paid on foreign income?

File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession.